William J. Ferry, a former stock broker and investment adviser, was convicted Tuesday for his part in a scam promising investors extremely high yields from a cut of humanitarian funds for relief from disasters such as Hurricane Katrina, which smacked New Orleans seven years ago today. Among those the 70-year-old Newport Beach man made his billion-dollar pitch to were undercover FBI agents.

]

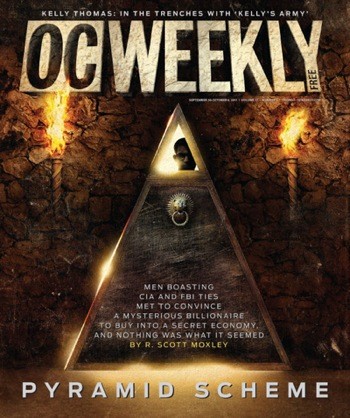

My colleague R. Scott Moxley wrote an excellent, twisty, true-crime cover story on the fraudulent scheme in September 2011:

From February to December 2006, Ferry pitched his “$1 billion” investment trade program to his potential marks. Claiming he was just awaiting any-day-now final clearance from the Federal Reserve Bank–a.k.a. “The Fed”–he laid out the plan.

According to the Department of Justice (DOJ), Ferry told the undercovers that for very little investment risk they would get a cut of funding from a Fed program that solicited project and humanitarian funds for disasters like Hurricane Katrina. They were further told the high yields would come after the Fed-approved and -regulated account divvied up funds equally between the humanitarian effort, project financing and the investors.

Among the false accusations about the totally phony baloney trading program: that once the program cleared compliance it would become registered by the Fed, that program managers had followed strict Fed

guidelines, that a Fed trade administrator administered the

program and that compliance duties were handled by a Fed compliance officer. Ferry acted as an underwriter

and member of the compliance team.

A DOJ statement says that the undercover FBI agents were told they would get to meet a Fed official and/or the chairman of the

board of a major U.S. bank to confirm the existence of the trade program, and that the investors funds would be kept in an offshore bank account managed by a Swiss banker who was already managing billions of

dollars for those who set up the program.

Indeed, to make the scheme seem legit Ferry of course needed help. Former real estate investment manager Dennis J. Clinton, 64, of San Diego, acted as a troubleshooter during the compliance phase and

transfer of funds to the Swiss banker. The role of banking expert was played by Paul R. Martin, 63, a former senior vice president and managing director

of Bankers Trust out of New Jersey. Californian Brad Keith Lee was the contact with the

Swiss banker, Oregonian John Brent Leiske acted as the trader, and Canadian Alex Chelak is charged with

having acted as a compliance officer.

With the evidence of the dupe in hand, all those men were indicted on Aug. 21, 2008, as were Iowa's Richard Arthur Pundt and Florida's Ronald J. Nolte. Charges against Pundt were dismissed in August 2010, and Nolte was acquitted in federal court in Santa Ana on Tuesday.

Not so lucky were Nolte's co-defendants Ferry and Clinton, who were each found guilty by the same federal jury in Santa Ana of one count of conspiracy, two counts of mail

fraud and six counts of wire fraud. They face up to 20

years in the federal pen on each fraud count at their scheduled Feb.

1, 2013, sentencing.

“Mr. Ferry and Mr. Clinton tried to dupe undercover agents into

believing their high-yield investment program would earn them extremely

high rates of return,” says Assistant Attorney General Lanny A. Breuer in the DOJ statement. “In fact,

Ferry and Clinton were conspiring to steal their money, along with the

money of trusting investors.”

At a separate trial, Martin was convicted Feb. 1 on the same counts as Ferry and Clinton. Martin faces the same prison stretch at his looming sentencing. Lee, who had pleaded guilty to wire fraud and conspiracy to

commit mail and wire fraud, was sentenced on Jan. 11, 2010, to 24

months behind bars. Leiske pleaded guilty of all counts against him this past Jan. 24 and he is to be sentenced on Sept. 19.

Chelak remains a fugitive, reports the DOJ.

Follow OC Weekly on Twitter @ocweekly or on Facebook!

OC Weekly Editor-in-Chief Matt Coker has been engaging, enraging and entertaining readers of newspapers, magazines and websites for decades. He spent the first 13 years of his career in journalism at daily newspapers before “graduating” to OC Weekly in 1995 as the alternative newsweekly’s first calendar editor.

Please help my family since 2016 we have been and continue to be physically harassed by cybercrime perpetrators affiliated with john brent lieske, Sheridan or fed prison camp inmate Robert flanagan fci Sheridan oregon federal prison fci whom my hard evidence july7, 7, 9, 2021 hacked my usaa federal savings bankacct made fraudulent Bank wire transfers to diana mariaflanagan jp morgan chase bank acct Heath OH Jodi Steven’s uncooperative with Michelle usaa fraud services repre. It’s 2024 Feb we continue to be. Compromised correspondence by federal indictmen fugatives Alex chelak Canadian Resident and dennis clinton William ferry dover perry , att inter remote support joshua winkler compromising my families sprint tmobile cricket wireless accts iPhone pro max stuck I carrier services Carmel mtn rd sd ca 3rd party store owner Aug 2022 unresolved and April 2020 my personal att acct never closed same month My fb cjmaldonado075 compr by unknown checkin mother earth in Belgium my id Sept 2021 us districtattornrys office district of Kentucky 3 inter secofficers russianfsbcenter16hackers compr 130 countries via power source compt computer mainframes my reportsubmissions o fbi 89 ic3s tips78 compr my my id anthony roy 147 perp April 2021 rodney scott Washington DC stayed with neighbor across street I will be kindly requesting the neighbors assistance as well as cybercrime perpetrators from Michigan my photoid Aug 2021 male blackbomberjacket shortshghponytail standing next to vehicle in sugarberry cultesac glancing towards our hoa residence we purchased Oct 2020 from noel garibay my neighbor Nick novachek told me noel is a cia operative I havet been able to get ahold of as all my calls on my tmobile compromised correspondence jay manager in temecula ca tmobile store says tmobile doesn’t help victims of cybercrime. Even if it’s notated in our candnmaldonado acct the rep emails I id and the perpetrators on fbi most wanted list etc murrieta ca pd June 9 2021 cybercrime social media id theft fraud embezzelment robbed extortion in cyberspace inv officers my id compromising all correspondence cybercrime perp imp det carla sanchez James tompkins Sargent Enrique romero matthew guzzino p1154 951-290-1923 transferred case report to Canadian mounted police whom we have yet to hear from, my numerous report submissions and multi million dollar lawsuit claims and business investments scorp acceleratedwoundcarespecialists palmspall hospice care dissolved my fathers multi million dollar lawsuit claim compromised by cyberrime per impersonating middlemen attorneys to deceive both parties my aaa autoclub not at fault mva compromised byperpetratos defamating my character male caucasion wearing makeup following me Jan 4 2021 female yelling at me and crowd pointing to me “it was his fault” My id Arbitration zoom conference video Call brent hales my attorney Chad visessung uic casulry adj aka affiliated Iranian cyberactor compr $1.2million dollar approved settled aaa accepting full responsibility for insured motorist causing accident David Pauley I submitted reports and kindly requested my attorney to verify Chad visessung uic casulty adj aaa representation due to numerous changes within the adj auto accident clearly my id being compromised as well as my email sent to all parties response Chad visessung disabled and my attorney told me he refused to rep trial and recommended I use my own medical insurance for ongoing loss of hip and right knee and diagnosis cervical myleopathy surgery because he couldn’t get Chad visessung to coop with the claim amount. I am so dissapointed as my character continus to be defamated also by my unpaid wages commissionlawduit claim against Wound Pros llc Dr otiko Christopher russian Nigerian ceo dr bill releford. Podiatrist and whom along with john brent lieske rodney ladale scott dover perry Arnold manansala my friend Martin Nunez married maiden name erwin targeting my family since my release 2016 I have photos of pers attending del mar ca San diego ca mudrun physically following us diana Maria flanagan wearing white pink glasses and my nephew navy intelligence petty officer Zachary miles my wife risk manager berkshire hathaway homeservices nichol maldonado Marlee Blaylock etc my submission ic3 to fbi my wife had to go to del mar ca corporate office servers overheated which I clearly id perps trying to compr Warren buffets company just another ic3 I don’t receive recognition or and reward or even any assistance from fbi to apprehend perpetrators or retrieve our loss of savings as well as he’ll I submitted a report to Michael hestrin da Riverside ca spoke with rep then received a letter stating I refused to proceed with att claim which is more corr compromised my att compromised my sprint tmobile cricket wireless iPhone pro11 mark hendriexx tmobile perp stuck in carrier services sprint romeo bundoc Juan Nunez Jillian Carmel mtn rd sd ca compromising our requests for help from cia as I id Louise Barnes on interpols watchhlist doj cia fbi oc wholesalers com Santa Ana ca luquidationcompany number 714 owned by Barnes compr by Anthony roy 147 perp Hopkins 00995@gmail fedex ground civil3 lawsuit anthony vs fedex roy guitirrez and me being compr 2010 Austin TX by russianfsbcenter16hackerswheniwasemployedwirhdynasplintsystemsalsomichiganperpstrongpossibility will. E inv by us attorneys office los angeles ca and I willnever give up so those that left my family financially devastated broken targeting also now our granddaughter sageryan maldonado palumbo 9months newborn she will never be given the opportunity to make the choice to make a difference in hers as well as others lives due to these narcissistic sociopaths dictating victimizing her life I have aamsung galaxys20fe serielnumber changed ten removed by perpetrators also immense amount of messenger platform fb and whatsapp correspondence compromising Mark z platforms I have been trying to connect with him to help his platforms as well as my 46 gmail accts compromised by perps fbimostwanted profile pics pop up upon me signing in also 3 ip address compromising all my cell phones wfi frontier eero compr by spectrum cable technician ans my id cybercrike perps organized crime consisting of cable techniciantony poway mesa mobile home estates poway ca whom comrour desktop when we lived wayland grove crt poway ca our residence burglarized i told inv the invidiuals that were at my residence that day ray vigil his girlfriend whom took off to texas that same day tony whomi thought was my friend i havent been able to conect i stopped by his residence no answer also my neighbor i havestrog possibility justin williams and also william zamora perp whom lied to tijuana drug cartel affiliations rodney erwin tara erwin walsh isreal ornelas comp our cricket wireless impmy report submissions also ms13and hells angels lied to as well by perps defamating our character rodney scott borderpatrol catain coronado cayes strand tyler sylvester coronado cayes dynasplint manager my 6 submissions to sdpd compr by perps as well as my id alexchelak compr my entire life deceiving law enforcement imp law enforcement dennis clinton imp fbi john brent lieskeimp cia operativealso cybersecurity center san bernardinoca 4 perpetrators i id and also my id finding hidden cameras in our hoa residence in smoke detectors tvs light fixtures also compr my wifes berkshire hathaway homeservices desktop computer by perps my wife and i arge daily she is afraid of anymore problems arise if i keep requesting for help but my id mpd officer i spoke with and my hard evidence perps tresppassing i have finger prints on a frame photo i will be getting prints checked by law enforcement as well askindky requesting Chief of police tony conrads assistance as fbi director stated on cnn 3 days ago china strong possibiity will try to compromise power sources which i have been submitting since2021 our power sources water etc already being compromised by china and another 2 country i have strong evidence but no one is listening to me and tracking every location I goto to compr my need for the country to be safe from being compromised latest drug enforcement agency San diegoca onsight attempt to meet with my friend Joanne Camacho unsuccessful I met with duty officers 1 caucasion 1 hispanic 1 security guard 2 females clearly signs of hispanic male odd in nature and responses upon me reporting 4 of our mobile phone prov comp and my id Louise Barnes ocwholesalers Santa Ana ca liquidation company on interpols watchlist I reported to cia and interpol first alsoaffili liquidation companies Florida and Colorado Springs which is where I id located Ryan Griffith It tech team makenna wound pros llc and also compr my ide twin brother Chad Maldonado Pueblo Co Verizon wireless cell phone but forget that my twin bro is an selfish asshole so disregard t

I’m still Christopher Maldonado The biggest cyberattack victim compromised correspondence, all of my entire life personal information multi million dollar business investments and lawsuit claims my family are the plaintiffs all settled and approved but never received due to my identification fbi most wanted affiliated iranian cyberactors I id on us soil impesonat8ng the officials that awe fuck it fuck off 3 ip addresses that keep on defamating my character and but just know that my immense amount hard evidence you’ll never have I sleep eat go doodoo and take with me everywhere I go even though you perps keep tracking my mercedes c300 imp law enforcement officers to well those that allow it and go along with mycryforhelp and those that are the ones that can’t seem to stop following me physically hacking my compromising my usaa bank accts to make fraud bank wire transfers to diana maria flanagans jp morgan chase bank acct perp robert flanagan and his 2 minions sons that also federal indictment fugatives alexchelak dennis cilinr9n William ferry and also their families trying to make it appear that my family is affiliated with you criminals we are lawabidingcitizens nectar bullfrog clinton and also your kids and wifes you all are breaking the law by compromis8ng my families and defanting our characters along with perps from Michigan and I just identified that Noel garibay isn’t a cia operative he’s a damn relegate investment advisor the is affiliated with you perps along with the organized crime I id but won’t state until I have in front of me I mean in front of me not compromised law enforcement officer but my friend Joanne Camacho gabrielke dudgeon and Dylan aquino doj whom I know will be ethical and never mistreat victimize ny family as since reporting being a victim of cybercrime social media id theft fraud emvmbezzelment extortion in cyberspace perps anthony roy 147 fb rodney ladale scott and my ud 3 intern securoties officers aka Russian fsb center16 hackers I have animmense amount of hardevidence that the amateur perp I id roy guitirrez and Jerry ribiello and also the cable tech organized crime perps also my mobile phone not 1 but 2 but 3 but 4 all compromised I have sim cards cell phones stuck in carrier services and all the mother fucking supporting data reportsubmissions cert9fied letters received Michael hestrin da Riverside ca my $85million you perps have in your possession will be mine and you’ll all be where you belong cois byrd detention facility aka southwestern detention facility aka fuck superior court Auld rd murroeta ca 92562 where I have hard evidence tge perps compromis8bv ny defamt8bg ny character and following me physically harassing me in a court room att3fanxe as well as the perp I id affiliated with the perp that said it is her daughter restraining irder wearing kcackisand divkies and checkered button up that was removed from courtroom and sent to 1st floor also I id every damn one of you so obvious I have license plates fuck you hey any one of those opportunist9c women want to help organize what I have already fir my resubmissions that are Goin to be compromised nomo 26267 jasmine avd murroeta ca 92563 858-663-8466 text me the perps keep forwarding my tm9bile calls to to the compromised by isreal ornelas perp my cricket wireless cell phobe as well as cjanig the ip address on all of my cell phones but hey I HAVE HARDEVIDENCE BOXESRECRIPTS NOONWWILLEVERHAVEBUTMEDEADBEATS

I’m still Christopher Maldonado The biggest cyberattack victim compromised correspondence, all of my entire life personal information multi million dollar business investments and lawsuit claims my family are the plaintiffs all settled and approved but never received due to my identification fbi most wanted affiliated iranian cyberactors I id on us soil impesonat8ng the officials that awe fuck it fuck off 3 ip addresses that keep on defamating my character and but just know that my immense amount hard evidence you’ll never have I sleep eat go doodoo and take with me everywhere I go even though you perps keep tracking my mercedes c300 imp law enforcement officers to well those that allow it and go along with mycryforhelp and those that are the ones that can’t seem to stop following me physically hacking my compromising my usaa bank accts to make fraud bank wire transfers to diana maria flanagans jp morgan chase bank acct perp robert flanagan and his 2 minions sons that also federal indictment fugatives alexchelak dennis cilinr9n William ferry and also their families trying to make it appear that my family is affiliated with you criminals we are lawabidingcitizens nectar bullfrog clinton and also your kids and wifes you all are breaking the law by compromis8ng my families and defanting our characters along with perps from Michigan and I just identified that Noel garibay isn’t a cia operative he’s a damn relegate investment advisor the is affiliated with you perps along with the organized crime I id but won’t state until I have in front of me I mean in front of me not compromised law enforcement officer but my friend Joanne Camacho gabrielke dudgeon and Dylan aquino doj whom I know will be ethical and never mistreat victimize ny family as since reporting being a victim of cybercrime social media id theft fraud emvmbezzelment extortion in cyberspace perps anthony roy 147 fb rodney ladale scott and my ud 3 intern securoties officers aka Russian fsb center16 hackers I have animmense amount of hardevidence that the amateur perp I id roy guitirrez and Jerry ribiello and also the cable tech organized crime perps also my mobile phone not 1 but 2 but 3 but 4 all compromised I have sim cards cell phones stuck in carrier services and all the mother fucking supporting data reportsubmissions cert9fied letters received Michael hestrin da Riverside ca my $85million you perps have in your possession will be mine and you’ll all be where you belong cois byrd detention facility aka southwestern detention facility aka fuck superior court Auld rd murroeta ca 92562 where I have hard evidence tge perps compromis8bv ny defamt8bg ny character and following me physically harassing me in a court room att3fanxe as well as the perp I id affiliated with the perp that said it is her daughter restraining irder wearing kcackisand divkies and checkered button up that was removed from courtroom and sent to 1st floor also I id every damn one of you so obvious I have license plates fuck you hey any one of those opportunist9c women want to help organize what I have already fir my resubmissions that are Goin to be compromised nomo 26267 jasmine avd murroeta ca 92563 858-663-8466 text me the perps keep forwarding my tm9bile calls to to the compromised by isreal ornelas perp my cricket wireless cell phobe as well as cjanig the ip address on all of my cell phones but hey I HAVE HARDEVIDENCE BOXESRECRIPTS NOONWWILLEVERHAVEBUTMEDEADBEATS oh I have the origional email I sent kindly requesting gov official etc assistance and all responses confirmation submissions I sent the perps scrambles versions I do not have

Heelp26267jasmineavemurrietaca

Heelp26267jasmineavemurrietaca